[ad_1]

Nevena1987/E+ via Getty Images

Lulu’s Fashion Lounge Holdings, Inc. (NASDAQ:LVLU), a digital female clothing business, has not managed to win over investor confidence since its IPO in November 2021. The expectation was for the initial price to be between $16 and $19 per share. Although it reached a high of $19.68 in June of this year, the stock price is currently at a very low $5.06.

LVLU Stock Price over 1 year (SeekingAlpha.com)

I previously wrote about LVLU when the stock price was at $11.86. Since then, the price has dropped by 57.76%. Two significant factors led to the steep decline. First, there was a downgrade from Piper Sandler, which was unimpressed by LVLU’s performance compared to other digital brand peers. Second, the company’s second-quarter results were heavily impacted by higher shipping costs and the number of returned goods, which significantly reduced the gross profit margin by 4% to 45.8%.

Although wary of the lower margins and the fierce competition LVLU faces, I believe there is still upside potential for this very cheap and relatively new player in the stock market. The company has performed well on many key growth factors amidst tricky macroeconomic conditions. The company has significantly increased its number of customers, average order value, and revenue over the last year. As shipping rates return to normality, their impact should be less severe in the long run. With a strong top and bottom line performance, positive expectations for the following earnings report, and a strong brand loyal customer base, I believe investors may want to take a bullish stance on this company.

The digitally native playground

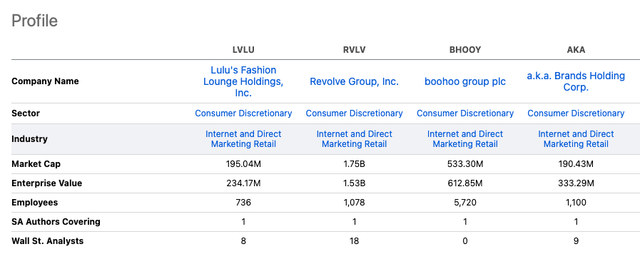

The term connected to LVLU and fellow peers born digital and operate predominantly online is “digitally native.” LVLU competes against many types of digital clothing companies, but the most significant are Chinese fast-fashion company Shein, which is reported to IPO in the United States by 2024; Princess Polly, which is part of the a.k.a. Brands Holding Corp. (AKA) portfolio; Revolve (RVLV); and PrettyLittleThing, which is part of the boohoo group plc (OTCPK:BHOOY).

Although LVLU has a more significant number of customers than the majority of its peers, it has performed poorly on Google Trends, Earned Media Value, and specific online customer surveys. There is a threat that in this competitive market, the growing strength of its peers could limit LVLU’s future position and market share. It was one of the critical reasons analysts downgraded their ratings to “Neutral.”

The market share potential cannot be ignored, especially for a company in its growing phase. The number of active customers increased to 3.2 million since the prior year, a growth of 53%. Furthermore, the average order value increased by 13% compared to the preceding year. This pattern shows that LVLU remains a strong brand in the online fashion shopping field with a very loyal customer base.

The unexpectedly high shipping costs reduced earnings per share to $0.15. It was $0.13 lower than the prior-year quarter. However, there seems to be a change in the winds and an expectation for LVLU to see a double-digit share price once more as they near their next earnings report release date.

Valuation

I do have to address that Shein will be a significant threat to the digitally native clothing brands if it enters the U.S. stock market. It is seen as the most extensive online-only clothing retailer, valued at $100 billion, overtaking the likes of H&M and Inditex. It accounts for 28% of the market share in the U.S. for fast fashion and targets Gen Z with highly competitive pricing and data-driven on-demand manufacturing. However, I believe there is a proper place for LVLU, which has grown a loyal customer base that perceives the brand as more than just an item of clothing. There is a sense of community around the online retailer, and a large percentage of its consumers are Millennials looking for quality rather than fast-paced fashion.

If we compare LVLU to some of its digital peers, we can see that the company is tiny at a market cap of $124.04 million. Its enterprise value is higher than its market cap, which investors should be wary of, but the company is young and clearly in a growth phase, requiring it to take on debt to invest in the business.

LVLU and Digital Peers (SeekingAlpha.com)

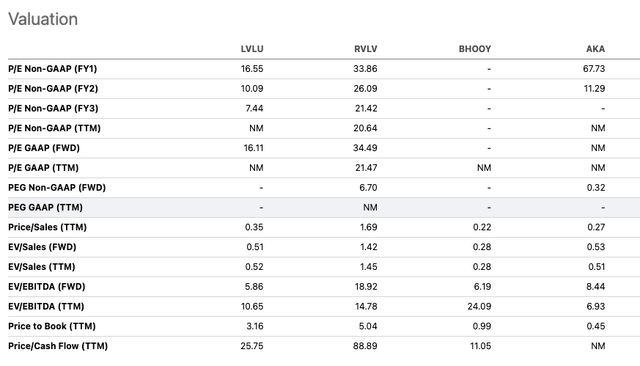

If we look at the relative valuation, we can see that several ratios indicate that LVLU may be undervalued. With a price-to-sales ratio of 0.35, investors put in less than a dollar for every dollar of revenue the company makes. It has a lower price-to-earnings ratio relative to its peers, showing us that the company may be undervalued. Various Wall Street analysts recommend this stock as a Buy, which can also give us confidence.

Relative Valuation with Peers (SeekingAlpha.com)

Final Thoughts

A downward trend of over 50% in the stock price is not an inviting sign to see in a stock. However, if we consider that LVLU is relatively new on the stock market and has not yet found its footing, we can see that the stock price is susceptible to analyst reviews and information from the earnings reports. This can work in a negative light, but also in a positive light.

With the upcoming release of the following earnings report and LVLU reporting record sales in Q3 2021, I believe there could be some potential upside to investing in this currently very cheap stock, especially if we consider that the fundamentals of the company are strong and the top and bottom lines are trending upwards in their quarterly performance.

[ad_2]