[ad_1]

The massive opportunities presented by nearshoring were all the rage last week at a packed energy conference in Monterrey, Nuevo León.

Industry Exchange LLC’s 8th Mexico Infrastructure Projects Forum kicked off with government officials and executives expounding on the theme. Nuevo León Economy Secretary Iván Rivas said, “We will do everything to take advantage of U.S. companies relocating their companies from Asia to our state.” He highlighted the booming state’s geography, human capital, infrastructure, industrial parks and security.

This story originally appeared in NGI’s Mexico Gas Price Index. To read the rest of NGI’s coverage of the Monterrey show, as well as our daily Mexico natural gas news, price and flow data, request a free trial.

Rivas said natural gas is the base of the nation’s electric power system. “But we have challenges in transmission and distribution,” with power output doubling in Nuevo León over the last 10 years to 34 TWh annually.

Rivas recently attended the World Economic Forum in Davos, Switzerland. There, he said, the topic on everyone’s lips was nearshoring. “Supply chains are changing and becoming more regional. What is being sold in North America needs to be produced here. This is nearshoring or friend-shoring…. And everyone held up Monterrey and Mexico as an example of this.”

[2023 Natural Gas Price Outlook: How will the energy industry continue to evolve in 2023? NGI’s special report “Reshuffling the Deck: High Stakes for Natural Gas & The World is All-In” offers trusted insight and data-backed forecasts on U.S. natural gas and the global LNG markets. Download now.]

He highlighted Nuevo León’s relationship with Texas, just up the road from the event and the eighth largest economy on earth. Of the 140 projects being developed in Monterrey, 51 involve U.S. companies. Some 30% of the projects under development are in the energy-intensive manufacturing segment.

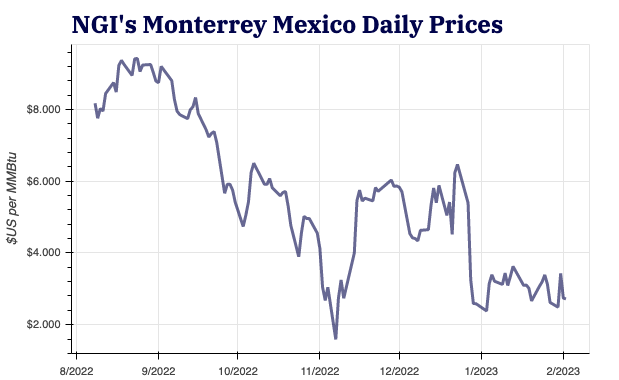

Almost all of the natural gas used in Monterrey’s industry comes over the border from Texas.

‘We Can’t Let It Pass By’

José María Lujambio, partner and energy practice director at Cacheaux, Cavazos & Newton, summed up the mood by saying that “nearshoring is the type of opportunity that comes once every 100 years. It has to do with a reshaping of the global order.”

The president of power group Asociación Mexicana de Energía (AME), Abraham Zamora, said, “We think nearshoring is a big opportunity in Mexico. We can’t let it pass by.” Members of AME represent 33 GW worth of power capacity in Mexico, of which natural gas power plants account for 23 GW.

Zamora cited studies showing that nearshoring could mean $36 billion/year in additional exports out of Mexico.

“But we don’t invest enough in electricity in Mexico,” he said. Power demand is growing at 2.8%/year through 2035, according to projections published by Mexico’s Energy Ministry (Sener). “We need to invest in generation, but also transport and distribution. This is key to our energy security.”

Mexico needs $100 billion in new power plants in 2022-2036, or 56 GW of extra capacity in this period, according to Sener. Zamora said that “the political moment is a big opportunity with the upcoming change in government.” The private sector and government “have a lot more in common than many think,” he added.

Semiconductors, Electric Cars

The president of the sustainable development board for the northwestern state of Sonora, Francisco Acuña, said the “economic opportunity of nearshoring is giant.” Of particular importance, he said, is the development of the semiconductor and electric vehicle industries.

He said Sonora, in conjunction with the United States, is working on a plan that would expand logistics in the state to take advantage of a shared opportunity. He cited the recent visit of the Biden administration’s climate envoy John Kerry to Sonora.

“Nearshoring has a specific mix of logistics needs,” Acuña said.

The state is developing the 1 GW Puerto Peñasco solar power facility, along with other power plants adding up to 5 GW of new power capacity.

Sonora would also build new roads, expand port, airport and water infrastructure, and develop the entire supply chain for electric cars and semiconductors. This includes the extraction of lithium and other critical minerals and the manufacturing of chips, batteries and electric cars. Sonora is also the site of planned liquefied natural gas export projects that would use natural gas shipped in from the United States.

“We are also working to prepare the talent for the challenges of the state and region in nearshoring,” he added.

Power Infrastructure Crunch

Victor Cervantes of the government of the western state of Jalisco said power supply and distribution remained a challenge to nearshoring opportunities. Jalisco’s capital Guadalajara is a growing industrial center which gets natural gas from the United States via the Waha-to-Guadalajara, or Wahalajara pipeline system.

“We have a strategy to generate systems of investment with the private sector… We need to take maximum advantage of nearshoring,” Cervantes said. He also highlighted the state’s booming agriculture sector, and the opportunity for biogas and renewable natural gas.

Carlos Garcia, director general of energy agency Agencia de Energía of southeastern Campeche, said, “We are creating the right conditions for nearshoring. No one can complain that we haven’t opened up our doors.” He cited 30 years of experience in offshore oil and gas development, and strong public-private relationships in the petroleum industry including natural gas pipelines and industrial parks.

“All doors are open,” he said.

Natural Gas Driver

José Ramon Silva of the Comisión de Energía of northern Tamaulipas said it’s “a priority of our state to develop hydrocarbons. The Burgos Basin is an extension of the Eagle Ford…. We need to develop the Burgos Basin and natural gas storage and that is also a priority for us.”

He said that “extensive natural gas networks will help us develop more efficient industrial parks.” He highlighted the development of desalination plants, the Port of Matamoros, the Sur de Texas-Tuxpan offshore natural gas pipeline, and the plans of New Fortress Energy Inc. to export natural gas from the state.

“We are very open to private investment and partnerships.”

U.S. Gas And Industrial Development

Raul Torres, director general of energy development in the central state of San Luis Potosí, said the confluence of three natural gas systems in his state provided a ripe opportunity for industrial development.

“We are working with industrial parks to find out where we can develop certain industries… We are a heavy industry state focused on manufacturing.” He said the 700 MW Villa de Reyes natural gas power plant being developed by the Comisión Federal de Energía (CFE) could “transform the area.”

[ad_2]